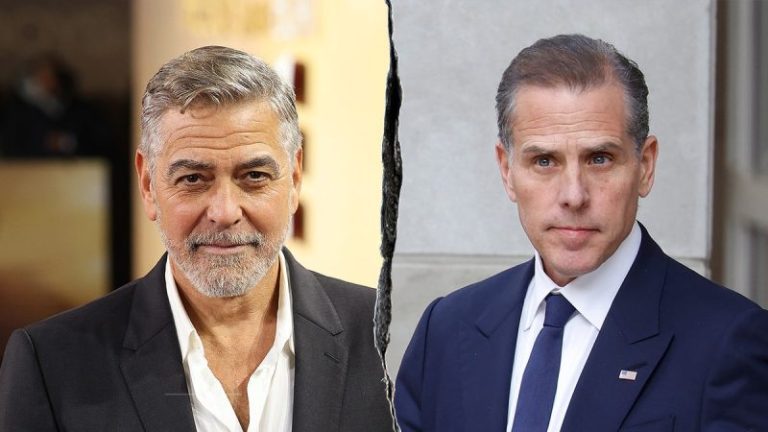

George Clooney is keeping quiet after Hunter Biden unleashed a string of vulgar attacks on the Hollywood actor.

Hunter, 55, accused Clooney, 64, of turning on his father, former President Joe Biden, and helping lead the charge to push him out of the 2024 race.

‘I love George Clooney’s movies, but I don’t really give a s— what he thinks about who should be the nominee for the Democratic Party,’ Hunter said on the ‘At Our Table’ podcast.

‘I was about to say I really like George Clooney as an actor, but the truth of the matter is, the truth is, I’ll be honest, I really don’t like George Clooney as an actor or as a person.’

Hunter recalled tensions between Clooney and his father behind the scenes at an event prior to the election.

‘George Clooney, before that event … literally threatened to pull out of the event — how many times? Five, six times? Over and over again, saying that he was so upset because my dad refused to recognize the arrest warrant for Netanyahu,’ Hunter said as he referred to the prime minister of Israel, Benjamin Netanyahu.

Hunter claimed Clooney’s behavior at the event was distant and alleged the actor only stayed for five minutes, spoke to no one except Barack Obama and ignored the rest of the crowd.

‘Literally, I was whispering in [Biden’s] ear saying, ‘Dad, f— him.’ … You got to be kidding me because I was so mad,’ Hunter added. ‘And he claims in his arrogance that my dad, the president of the United States, didn’t know who the actor was.’

Reps for Clooney did not immediately respond to Fox News Digital’s request for comment.

Clooney has yet to comment publicly on Hunter’s comments, even as the president’s son continues his media blitz.

In a separate appearance with Andrew Callaghan on his ‘Channel 5’ podcast over the weekend, Hunter’s criticism of Clooney escalated into a full-blown, hourslong meltdown accusing the ‘Ocean’s 11’ star of sabotaging his father’s re-election effort.

Hunter said the alleged move was made with ‘the blessing’ of former President Obama and his cohorts.

‘F— him! F— him and f— everybody around him,’ Hunter said bluntly. ‘I don’t have to be f—ing nice. No. 1, I agree with Quentin Tarantino. George Clooney is not a f—ing actor. He is a f—ing, I don’t know what he is. He’s a brand.’

The former president’s son’s rage emerged as they discussed Clooney’s infamous New York Times op-ed, which was published days after his father’s widely criticized debate performance.

Clooney called for Biden to step aside as the Democratic nominee at the time.

‘It’s devastating to say it, but the Joe Biden I was with three weeks ago at the fundraiser was not the Joe ‘big f—ing deal’ Biden of 2010. He wasn’t even the Joe Biden of 2020,’ Clooney wrote. ‘He was the same man we all witnessed at the debate.’

Clooney’s statement appeared to trigger a furious response from Hunter, who blasted the actor for spreading what he called false claims about his father’s mental health.

‘Why do I have to f—ing listen to you?’ Hunter asked during the podcast. ‘What do you have to do with f—ing anything?… What right do you have to step on a man who’s given 52 years of his f—ing life to the service of this country and decide that you, George Clooney, are going to take out basically a full-page ad in the f—ing New York Times to undermine the president?’

Biden withdrew from the race July 21, 2024, and was replaced on the Democratic ticket by Kamala Harris.

Hunter also noted Clooney was friends with former President Obama and only published his essay with the ‘blessing of the Obama team.’

‘You know what George Clooney did? Because he sat down with, I guess, because he was given a blessing by the Obama team, the Obama people and whoever else,’ he said.

In April, Clooney spoke with CNN’s Jake Tapper about writing the op-ed, saying it was his ‘civic duty.’

‘It was a civic duty because I found that people on my side of the street — you know, I’m a Democrat in Kentucky, so I get it. When I saw people on my side of the street not telling the truth, I thought that was time to … some people [are mad], sure. That’s OK, you know. Listen, the idea of freedom of speech is you can’t demand freedom of speech and then say, ‘But don’t say bad things about me,‘’ Clooney said.

While on ‘The Late Show with Stephen Colbert’ in February, Clooney spoke about Harris losing to Donald Trump in the presidential election.

‘I was raised a Democrat in Kentucky … and you know I’ve lost a lot of elections. … You know, this is democracy and this is how it works,’ he said.

‘It didn’t work out. That’s what happens. It’s part of democracy. … And, you know, there’s people that agree and people who disagree, and most of us still like each other. We’re all gonna get through it.’

Clooney spoke about President Trump again in April during an interview with Patti LuPone for Variety’s ‘Actors on Actors: Broadway.’

‘He’s charismatic. There’s no taking that away from him. He’s a television star. But eventually we’ll find our better angels. We have every other time,’ he said.

‘If you’re a Democrat, we have to find some people to represent us better, who have a sense of humor and who have a sense of purpose. I think we’ll get the House back in a year and a half, and I think that’ll be a check and balance on power.’

Earlier this year, Clooney was thrust into the spotlight as questions about his family’s future in the U.S. under President Trump’s administration arose.

Clooney’s wife, Amal, is an international human rights lawyer born in Lebanon and raised in the U.K., and she holds legal credentials in both Britain and the United States.

Amal reportedly gave legal advice in a war crimes case against Israeli Prime Minister Netanyahu and Israeli Defense Minister Yoav Gallant over the war in Gaza, according to the Financial Times.

A Trump executive order claimed the court ‘engaged in illegitimate and baseless actions targeting America and our close ally Israel. The ICC has, without a legitimate basis, asserted jurisdiction over and opened preliminary investigations concerning personnel of the United States and certain of its allies, including Israel, and has further abused its power by issuing baseless arrest warrants targeting Israeli Prime Minister Benjamin Netanyahu and Former Minister of Defense Yoav Gallant.

‘The United States will impose tangible and significant consequences on those responsible for the ICC’s transgressions, some of which may include the blocking of property and assets, as well as the suspension of entry into the United States of ICC officials, employees, and agents, as well as their immediate family members.’

Clooney proposed to Amal in April 2014, and the couple married five months later in Venice, Italy. In 2017, the Clooneys welcomed twins Alexander and Ella.

Fox News Digital’s Tracy Wright contributed to this report.