Former National Security Advisor Mike Waltz is poised to face members of the Senate on Tuesday to get the ball rolling on his nomination to represent the U.S. at the United Nations.

Waltz’s appearance before the Senate Foreign Relations Committee comes months after he exited his job at the White House amid controversy surrounding his role in a Signal group chat with other top administration officials.

Democrats vowed to grill Waltz during his confirmation process in the aftermath of The Atlantic magazine’s reporting about a Signal group chat that his team had set up to discuss strikes against the Houthis in March.

Even so, the tough questioning from Democrats on the so-called ‘Signalgate’ issue isn’t expected to derail Waltz’s confirmation to the post, given that Republicans hold a 53–47 majority in the Senate.

‘It’s all theater — you know he’s going to get confirmed,’ a GOP foreign relations source told Fox News Digital. ‘If Signalgate’s a big thing against him, it wasn’t enough to get anyone else fired or impeached or anything like that.’

Waltz, a former congressman who represented Florida’s 6th congressional district, is a retired Army National Guard colonel and former Green Beret. During his time in uniform, he served four deployments to Afghanistan and earned four Bronze Stars — the fourth-highest military combat award, issued for heroic service against an armed enemy.

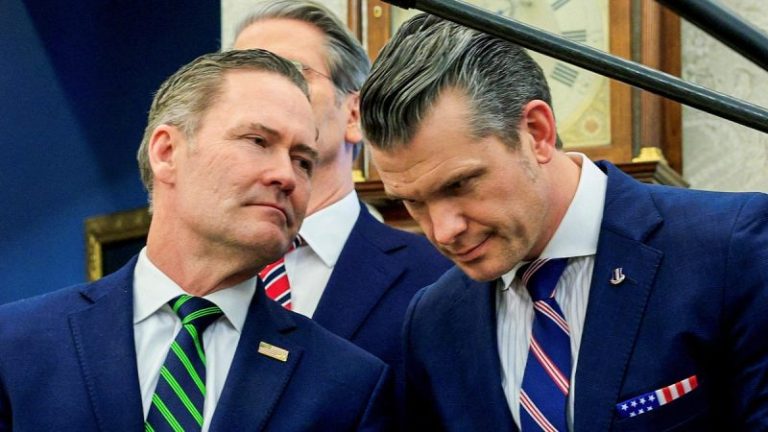

Waltz and Secretary of Defense Pete Hegseth were both entangled in the Signal chat that Waltz’s team created where members of the Trump administration discussed strike plans against the Houthis.

Waltz in March said he took ‘full responsibility’ for the Signal group chat, and the Trump administration has maintained that no war plans were shared in the chat. The Atlantic published the full exchange of messages, which included certain attack details such as specific aircraft and times of the strikes from Hegseth.

On May 1, President Donald Trump announced Waltz’s departure from his role as national security advisor and hours later unveiled the former Florida congressman’s nomination to represent the U.S. at the U.N.

Democrats called for Hegseth’s resignation as a result of the chat and warned that Waltz would face the heat during the confirmation process for U.N. ambassador.

Democratic Sen. Tammy Duckworth of Illinois said in a May interview with CBS News that Waltz could count on a ‘brutal, brutal hearing’ from senators, and described his nomination as ‘failing up.’

‘He’s not qualified for the job, just by nature of the fact that he participated in this Signal chain,’ Duckworth, a member of the Senate Foreign Relations Committee, told CBS News.

Duckworth, who served in the Illinois Army National Guard as a Blackhawk helicopter pilot and lost both of her legs during a 2004 deployment to Iraq, told Fox News Digital Monday that Waltz’s involvement in the group chat should disqualify him from serving as U.N. ambassador. She also said that every official included in the chat should be fired.

‘As a retired Soldier, Waltz should have shut the unclassified chain down as soon as he saw Hegseth share such classified information that could’ve gotten our pilots killed,’ Duckworth said in a statement. ‘It’s clear Waltz cannot be trusted to make critical and sensitive national security decisions, and I look forward to pressing him on his conduct and holding him accountable.’

Duckworth has pinned most of the blame on Hegseth for Signalgate. Prior to Trump’s announcement on Waltz’s U.N. ambassador nomination, Duckworth said in a May post on X that of ‘all the idiots in that chat, Hegseth is the biggest security risk of all — he leaked the info that put our troops in greater danger.’

In addition to Waltz and Hegseth, administration officials including Vice President JD Vance, Secretary of State Marco Rubio and CIA Director John Ratcliffe were part of the group chat.

Additionally, ranking member of the Senate Foreign Relations Committee Sen. Chris Coons, D-Conn., said that Waltz could brace for a meticulous confirmation hearing before the committee’s members.

‘I look forward to a thorough confirmation hearing,’ Coons said in a post on X in May.

A spokesperson for Coons did not respond to a request for comment from Fox News Digital.

The GOP foreign relations source described the fallout from Signalgate a ‘huge nothing burger,’ and pointed out that Democrats’ previous efforts to use Signalgate against Waltz and Hegseth have proven unsuccessful.

‘If this was their deathly bullet, it would have killed Hegseth, and it would have killed Waltz, but they’re both left standing,’ the source told Fox News Digital.

A Senate aide told Fox News Digital that while Waltz took the brunt of the blame for Signalgate because his team created the chat, Democrats’ expected questioning of the group chat during the hearing is actually about finding a new avenue to go after Trump.

‘I don’t think he’s the target. He’s just the mechanism to go after the target,’ the Senate aide said. ‘At the end of the day, Democrats want to criticize and go after the president, so these guys are just a mechanism to get there.’

Meanwhile, Republican lawmakers have voiced support for Waltz, with Senate Foreign Relations Committee Chairman Sen. Jim Risch, R-Idaho, calling him a ‘great choice’ for the position in a post on X in May. Additionally, Sen. Lindsey Graham, R-S.C., said at the time that the Senate would ‘for sure’ confirm Waltz.

‘Some things I know for sure: the sun rises in the East, sets in the West and Mike Waltz will be confirmed as the next UN Ambassador,’ Graham said in an X post in May. ‘He is highly qualified, well-positioned, and will be a strong voice for our nation at the UN.’

Since Waltz’s departure as serving as national security advisor, Rubio has stepped in to fill that role.

Trump previously nominated Rep. Elise Stefanik, R-N.Y., to represent the U.S. at the U.N. However, her nomination was pulled in March, and Trump claimed at the time that the House could not give up another Republican seat with its slim 220–212 Republican majority.

If confirmed as U.N. ambassador, Waltz would be responsible for representing U.S. interests at the U.N.’s New York headquarters, weighing in on resolutions, treaties and other global matters.

Waltz could not be reached for comment by Fox News Digital.

The 80th session of the U.N. General Assembly is scheduled for Sept. 9, providing a window of time for Waltz’s nomination to make it through the entire confirmation process beforehand.

‘The hope is to have him in place before the U.N. General Assembly is in session,’ the GOP foreign relations source told Fox News Digital.

This post appeared first on FOX NEWS