More than three decades after diamonds transformed Canada’s Northwest Territories (NWT) into a global mining powerhouse, the industry that once defined the region’s modern economy is facing a painful reckoning.

While governments and investors have spent the past several years focused on critical minerals and battery metals, the NWT’s diamond mines are grappling with falling prices, lab-grown competition, tariff disruptions and mounting financial strain.

With one major mine set to close within weeks and others under pressure, leaders across the North are asking a seemingly once unthinkable question: what comes after diamonds?

From staking rush to global player

The modern diamond era in the NWT began in November 1991, when geologists Chuck Fipke and Stewart Blusson discovered 81 small diamonds at Lac de Gras. The find triggered the largest diamond staking rush in North American history and led to the development of the EKATI Diamond Mine, Canada’s first.

By 2004, more than 28 million hectares across the NWT and Nunavut had been staked. Canada rose to become the world’s third-largest diamond producer by value, behind Botswana and Russia, largely on the strength of the NWT’s output.

For decades, the sector generated thousands of high-paying jobs and helped build Indigenous-owned businesses across the territory. At its peak, more than 3,000 Indigenous workers were employed at the region’s three diamond mines.

Today, that foundation is starting to show cracks.

All pressure, no diamonds

Rio Tinto’s (ASX:RIO,NYSE:RIO,LSE:RIO) Diavik mine, one of the pillars of the industry, is scheduled to close next month.

Although the company recently unveiled a rare 158.2-carat yellow diamond from the site last year, described by COO Matt Breen as a “miracle of nature,” the symbolic discovery cannot reverse the mine’s finite life.

In addition, De Beers ( a subsidiary of Anglo American (LSE:AAL,OTCQX:NGLOY)) and Mountain Province Diamonds’ (TSX: MPVD,OTC:MPVD) Gahcho Kué mine has paused a project that would have extended operations from 2027 to 2030, raising concerns about its longevity.

Meanwhile, EKATI, owned by Australia’s Burgundy Diamond Mines (ASX:BDM), is battling financial distress after diamond prices fell at least 20 percent following its acquisition of the asset.

In the legislature this week, Monfwi MLA Jane Weyallon Armstrong warned of the consequences.

“The closure of Diavik and Gahcho Kué will have a significant impact on Tłı̨chǫ communities and today, the GNWT has no meaningful alternative,” she said.

Premier R.J. Simpson acknowledged the challenge. “We’re at a point now where we know the diamond mines are winding down, and the question has been: ‘OK, well, what’s next?’” he said in a recent interview.

Market headwinds multiply

The industry’s struggles are not simply a matter of geology. Natural diamond prices have been under sustained pressure, battered by several macroeconomic forces converging at once.

For instance, lab-grown diamonds—chemically identical to natural stones and available at a fraction of the price—have rapidly gained acceptance among consumers. What was once a niche product is now mainstream, particularly among younger buyers drawn to lower costs.

Canadian diamonds long marketed themselves as ethical alternatives to so-called “blood diamonds.” But synthetic stones can make similar claims, weakening one of the natural industry’s key selling points.

Luxury spending has also softened, and new trade barriers have added further strain. A 50 percent US tariff on Indian imports has disrupted the global polishing pipeline, since most rough diamonds are cut and finished in India before being sold into the US market.

The owner of EKATI has linked its financial difficulties in part to those tariffs, as well as to the broader collapse in natural diamond prices. The company recently received a C$115 million federal loan under a facility designed to assist businesses affected by US trade disruptions.

Even so, EKATI suspended parts of its operations last year and has faced criticism from workers over layoffs and severance payments. Burgundy has publicly acknowledged serious financial problems and indicated it may need additional funding if prices fail to recover.

At Gahcho Kué, Mountain Province Diamonds is navigating its own funding challenges. Acting president and CEO Jonathan Comerford said the company’s difficulties reflect “the prolonged weakness in the diamond sector.”

“In this environment, our focus remains on carefully managing costs, protecting liquidity, and making measured decisions to support the long-term sustainability of our operations,” Comerford said.

The company has received in-kind funding notices from joint-venture partner De Beers totalling approximately C$49.2 million related to unpaid cash calls.

Political pressure builds

Territorial leaders are also under growing pressure to respond.

Minister of Industry Caitlin Cleveland described the Gahcho Kué announcement as “serious news for the Northwest Territories.”

“Prices are weak, costs are high, and companies are having to make difficult calls,” Cleveland said in a recent statement. She emphasized that while the GNWT cannot control global markets, it will work to ensure worker supports are accessible and employers meet labour standards if job impacts occur.

But some structural issues are harder to address. Yellowknife North MLA Shauna Morgan questioned how the government can enforce socio-economic commitments made by mining companies when they established operations.

Simpson conceded that those agreements lack enforcement clauses such as fines.

“This is about building relationships and ensuring that we’re staying on top of this,” he said.

Meanwhile, calls for diversification are growing louder. “This announcement also reinforces a broader reality for our territory: our economic base remains too dependent on a single commodity,” Cleveland said.

Searching for the next chapter

There are hopes that critical minerals could help fill the gap. Exploration for rare earths and other strategic metals is increasing, reflecting global demand tied to electrification and defense technologies.

Weyallon Armstrong has argued that infrastructure, including expanded road connections from the Tłı̨chǫ region, could unlock new development corridors.

“We may not have a Ring of Fire, but we could have a frosty circle,” she said, referencing Ontario’s mineral-rich region.

Yet even optimistic observers acknowledge that no single project is likely to replicate the scale and stability diamonds once provided. For community leaders, the uncertainty is deeply personal.

“It’s kind of a scary situation,” Chief Fred Sangris of the Yellowknife Ndilo community of the Dene First Nation told the New York Times last year. “Where do we go from here? What’s the next project?”

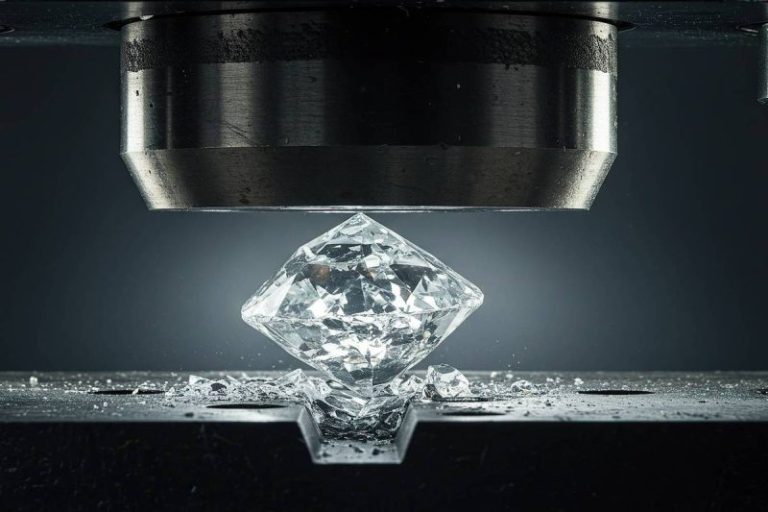

Diamonds have long symbolized permanence. In the Northwest Territories, especially this Valentine’s season where icons of everlasting love dominate the market, that symbolism now feels more strained than ever.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.